Gross Pay vs. Net Pay: Differences and How to Calculate

Businesses and employees often come across terms like gross pay and net pay on their payrolls and paychecks. These financial jargons can seem intimidating, and the lack of clarity between gross pay vs. net pay can have serious consequences for both. While businesses risk payroll errors and compliance-related exposures, employees are unable to plan their finances and budgets judiciously.

Both gross pay and net pay are components of an employee’s payroll. However, they’re not the same.

Here’s how.

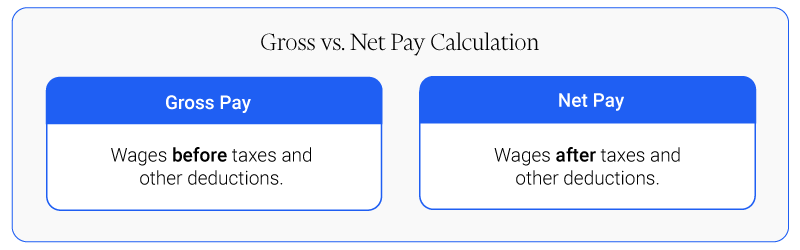

When a company hires employees, it promises to pay them an annual salary, which is the amount they would earn before any tax or payroll deductions. This amount is called “gross pay”.

However, employees receive their salaries after deductions like taxes and benefits. The actual amount they receive every month after accounting for all the deductions is called the “net pay”.

Going further, let’s first understand gross pay and what it entails in more detail.

What Is Gross Pay?

In the context of employment, gross pay is the total compensation that an employee earns for their work before any statutory deductions. Understanding its concept and definition is important as it lays the foundation for many different types of payments.

It consists of all forms of remuneration, including wages, salaries, bonuses, commissions, reimbursements, and other such monetary benefits. It’s calculated based on agreed-upon rates of pay and the number of hours worked or services rendered.

Gross pay includes wages or salaries and in case a person has two jobs, they’ll have a separate gross pay for each.

This pay functions as the foundation for deciding an individual’s net pay after tax deductions, insurance premiums, retirement contributions, and other withholdings. As mentioned, accurate calculation and reporting of gross pay are essential for regulatory payroll compliance and maintaining transparency in employment compensation practices.

Gross pay determines a person’s ability to make payments, especially to lenders or homeowners, and to estimate an individual’s income taxes. This makes it an important data point to consider and understand.

Components of Gross Pay

Gross pay consists of various components, as mentioned below:

Base Salary or Wages

The core component of gross pay is the employee’s basic salary or hourly earnings, the predetermined amount specified in the employment contract, and a central element of the individual’s compensation framework.

Overtime Compensation

In situations where employees work beyond the standard working hours, they may qualify for overtime pay.

Overtime compensation is usually computed at a higher rate than regular wages and determines gross pay significantly.

Bonuses

Bonuses are variable components linked to performance, achievements, specific milestones, and base pay. With their addition to the gross salary, these additional incentives give employees greater financial compensation for their contributions.

Commissions

For individuals in sales or revenue-generating roles, commissions are pivotal in determining gross pay. Commissions are a percentage of sales or revenue an employee generates, adding a variable yet substantial component to their overall compensation.

Benefits and Allowances

Certain perks and allowances, like housing, transportation, or meal benefits, are factored into calculating the total pay. Although not always provided as direct cash, incorporating the benefits and allowances improves the overall financial offer.

Shift Differentials

Employees working non-standard shifts, such as night or weekends, may receive shift differentials in occupations with varying work schedules. These differentials reflect the additional challenges of working non-standard hours that must be compensated as a part of the gross pay.

Holiday Pay

This type of pay recognizes an individual’s work during holidays and is an additional component of gross compensation. This payment adds to the employee’s total compensation package while acknowledging the impact on their time.

By breaking down these components, employers can create fair compensation plans and promote open communication. On the other hand, employees understand all the factors that contribute to their total salary. This enables them to determine the actual value of their labor and skillfully bargain for a higher wage.

Therefore, carefully examining the elements that make up gross pay reveals the complexity of employee compensation. A thorough understanding of the same fosters transparency in the employer-employee relationship and serves as a basis for equitable compensation methods.

Why Is Gross Pay Important for Employees?

Gross pay is important as it’s used for many purposes that may matter to an individual. Some of these benefits are as follows:

Helps Qualify for a Loan

Gross pay plays an important role when applying for a loan since it’s one of the criteria for loan approval. The gross pay must meet certain minimum requirements for a loan to go through.

Helps With Rental Housing

The gross pay of potential renters is usually assessed by homeowners to determine whether or not they would be able to pay their house rent consistently and on time.

Determining Credit Limit

Credit card issuers take gross pay into consideration when determining the credit limit.

Determining Taxes

Gross pay lays the foundation for federal and state tax agencies to determine how much an individual owes in taxes.

Negotiating Future Salaries

Awareness of current gross pay can help negotiate for higher net pay while exploring future employment opportunities.

How to Calculate Gross Pay

This can be calculated in two different ways based on the way the workers get paid:

Gross Pay Calculation for Salaried Workers

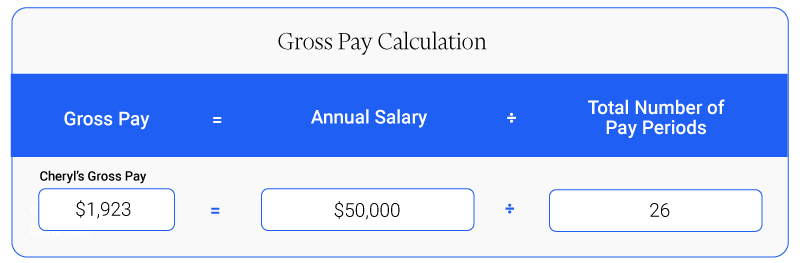

The gross pay of a salaried employee is calculated by dividing their total annual salary by the number of pay periods during the year.

In case a business pays its employees weekly, then an individual would have 52 weeks of pay in a year.

|

Formula Gross pay per pay period = Annual salary ÷ number of pay periods |

Gross Pay Calculation for Hourly Employees

The gross pay for hourly workers is calculated differently from salaried workers.

|

Formula Gross pay = Hourly Rate X Number of Hours worked |

For instance, if an individual works part-time for 35 hours per week at $12 for an hour, they will be paid $420 for that pay period. However, overtime rates will also be accounted for if they work overtime.

Note: An employee’s gross pay must meet the federal minimum wage or minimum wage of that particular state, whichever is higher.

Now that we have a detailed overview of gross pay let’s move on to understanding net pay.

What Is Net Pay?

Simply defined, net pay is the amount that an employee takes home directly from their paycheck after all deductions are made.

The taxable amount left over may be much lower than the gross pay when all deductions, both above and below the line, have been made.

Depending on the circumstances, the deduction may be mandatory or optional and could include income tax. These deductions may include charges for health insurance or superannuation.

Net pay for individuals varies greatly because it’s affected by deductions like taxes, wage garnishments, and other benefits. Factors like marital status, tax credits, location, and the number of dependents affect each individual’s net pay.

Below are some of the standard deductions made from the gross pay that result in the net pay:

- Taxes like healthcare expenses, social security, and state, federal, and local taxes.

- Pretax deductions like endowments toward company-sponsored retirement plans, such as 401(k)s, health and dental insurance, and flexible spending accounts (FSAs).

Pretax benefits can also be deducted from the gross pay. If they’re deducted before taxes, it reduces the take-home pay and also decreases the amount of tax withdrawn from the paycheck.

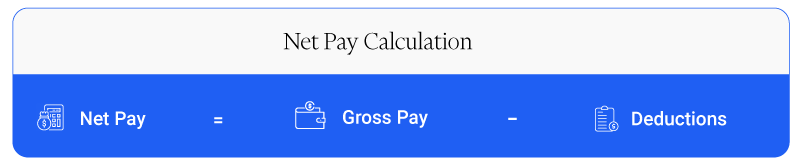

How to Calculate Net Pay

Determining net pay involves thoroughly examining various deductions influencing an employee’s total compensation. This detailed procedure includes subtracting several items from the gross pay to determine the final amount.

The subsequent step-by-step breakdown elucidates the importance of each deduction, offering examples to enhance understanding.

Step 1: Deduct Federal Income Tax

The primary deduction is the federal income tax, determined by the employee’s income and tax bracket.

Example: If an employee earns $50,000 annually and falls into the 22% tax bracket, the federal income tax deduction would be $11,000.

Step 2: Deduct State Income Tax

Besides federal taxes, certain states impose income taxes, further reducing the gross pay.

Example: If the state tax rate is 5%, the state income tax deduction for the employee in the previous example would be $2,500.

Step 3: Deduct Social Security and Medicare (FICA)

Employees contribute a percentage of their income to Social Security and Medicare, with matching employer contributions.

Example: If the Social Security rate is 6.2% and the Medicare rate is 1.45%, the combined FICA deduction for the employee earning $50,000 would be $3,825.

Step 4: Deduct Retirement Contributions

Before-tax calculations, voluntary contributions to retirement plans, such as a 401(k), are deducted.

Example: If an employee contributes $5,000 to their 401(k), this amount is subtracted from the gross pay before tax calculations.

Step 5: Deduct Health Insurance Premiums

The cost of health insurance premiums is often deducted, impacting net pay.

Example: If health insurance premiums amount to $2,000 annually, this sum is subtracted from the gross pay.

Following the steps above will help you arrive at an employee’s net pay salary.

Note: It’s important to keep in mind that non-mandatory contributions and benefits from the company’s end must be determined during the joining and mentioned in the employee’s offer letter to avoid any confusion.

Incorporating Pretax Benefits

Some benefits, like pretax benefits, can impact net pay positively. Both employers and employees can use these benefits to enhance overall compensation. This section explores particular pretax benefits such as Health Reimbursement Arrangements (HRAs) and stipends, offering insights into how they can affect employees’ financial well-being.

Health Reimbursement Arrangements (HRAs)

Health Reimbursement Arrangements (HRAs) enable employees to earmark pretax funds for eligible medical expenses, thereby lowering their taxable income. For instance, if an employee designates $2,500 for an HRA, this sum is deducted from their gross pay before tax computations.

Stipends and Allowances

Certain employers offer stipends or allowances for particular purposes, such as commuting or education, which could potentially be exempt from income tax. For instance, if an employer provides a monthly commuting stipend of $1,000, this sum might not be considered for income tax.

Employer Considerations

Employers are crucial in managing deductions because they keep abreast of benefits and tax legislation changes. It extends beyond compliance, as maintaining proper records and informing employees of deductions is essential. This two-pronged strategy increases an organization’s payroll management efficiency and transparency.

Staying Abreast Of Evolving Tax Laws And Benefit Regulations

The landscape of tax laws and benefit regulations is dynamic and subject to continual evolution. Employers must proactively stay informed about these changes, ensuring their deduction processes align with the latest legal standards. This attention to detail averts possible legal repercussions and demonstrates a commitment to ethical and legal payroll procedures.

Accurate Record Keeping

Accurate record-keeping is the bedrock upon which transparent payroll management stands. Employers must maintain meticulous records of all deductions, providing a clear, auditable trail. This safeguards organizations against non-compliance issues and instills confidence in employees, who can trust that their deductions are handled accurately and honestly.

Effective Communication

A positive employer-employee relationship is primarily based on honest discussions about deductions. Companies must set up unambiguous and succinct communication channels and promptly attend to any inquiries or apprehensions employees may have about deductions. This fosters trust and gives employees a better grasp of the reasoning for deductions, enabling a more informed and engaged workforce.

Calculating net pay involves navigating a complex path of deductions and considerations. Employers and employees can simplify this process by thoroughly understanding the deduction system. This ensures a fair and transparent compensation structure, showcasing the organization as an ethical practitioner of payroll management and promoting a positive work environment.

What Are the Differences Between Gross Pay and Net Pay?

Understanding the difference between gross pay and net pay is crucial for both employers and employees. It’s essential to comprehend the intricacies of compensation. By breaking down these financial aspects, individuals can simplify the complexity of payroll calculations.

Comparative Analysis: Gross Salary vs. Net Salary

|

Criterion |

Gross Salary |

Net Salary |

|

Deductions |

|

|

|

Perks |

|

Net salary helps lower the tax liability as a percentage of the net pay is deducted before paying the taxable take-home salary. |

|

Taxation |

Includes all taxes |

Doesn’t include taxes |

|

Value |

Usually higher than the net salary |

Usually less than the gross salary |

Understanding the distinction between gross vs. net pay isn’t merely a theoretical exercise. The implications extend beyond theory, directly affecting the practical aspects of employers and employees’ working relationship and financial standing.

Clear comprehension of net vs. gross pay is vital for fostering a transparent and cooperative working environment for both employers and employees. Let’s understand that in detail:

Employers

- Financial Planning: Employers, in their strategic planning, must factor in gross pay when drafting budgets for labor costs, bonuses, and benefits. This comprehensive financial planning ensures that resource allocation and management align with the organization’s overall financial goals.

- Compliance: Accurate payroll management is crucial for employers to follow tax and employment laws. Adhering to these rules helps avoid legal issues and maintains the organization’s reputation and integrity.

Employees

- Budgeting: Awareness of take-home pay is crucial for employees when creating sufficient budgets. Grasping the reductions from their total earnings empowers individuals to manage their expenditures prudently, fostering financial stability and security.

- Salary Negotiations: Knowing the total pay helps an employee understand the full value of their compensation. This knowledge is crucial when discussing salary, empowering them to seek fair and equitable pay based on their contributions and industry norms.

Understanding the intricate aspects of gross pay vs. net pay is essential for promoting clear communication between employers and employees. Both parties can work together to achieve financial transparency and effective payroll management by grasping how earnings, deductions, and contributions interact.

This understanding forms a crucial foundation for establishing a solid compensation structure and promoting financial well-being, enhancing the professional experience for everyone involved.

Are HRAs and Stipends Considered Gross Pay or Net Pay?

Health Reimbursement Arrangements (HRAs) and stipends play distinct roles in compensation structures and undergo differential treatment in gross and net pay.

HRAs are commonly recognized as a type of employer-sponsored benefit designed to assist employees with covering eligible medical expenses. Employers frequently contribute to HRAs, and these contributions are not considered part of the employee’s gross pay.

HRAs do not factor into gross pay calculations. Instead, they contribute to the comprehensive employee benefits package, aiding individuals in managing healthcare costs.

However, it’s essential to note that reimbursements from HRAs may become subject to income tax if not utilized for qualifying medical expenses.

On the other hand, stipends are generally incorporated into the gross pay. Stipends are a fixed sum of money regularly disbursed to employees, often to address specific expenses or as supplementary compensation.

Stipends are deemed part of the overall compensation before deductions, contributing to the gross pay calculation. Similar to other earnings, stipends may be subject to taxes and additional deductions, influencing the net pay received by the employee.

To summarize, HRAs are typically excluded from gross pay, as they form part of the benefits package, while stipends are considered part of the gross pay, subject to deductions that impact the net pay. Understanding these distinctions aids both employees and employers in navigating the intricacies of compensation structures and tax implications.

Understand Earnings With Gross and Net Pay

To promote equitable and transparent compensation plans, a thorough understanding of gross and net pay is a must for employers. For this, clear communication with employees promotes transparency and fosters trust in the payroll system, reducing the chances of misunderstandings. Employers and employees should meticulously handle tax regulations and deduction procedures to meet legal requirements.

On the other hand, employers must carefully manage tax regulations and deduction procedures to comply with legal mandates. Meanwhile, ensuring precise payroll processing is the key to proactively avoiding future legal complications.

Employees also greatly benefit from understanding these concepts to make wise financial decisions. Understanding the complexities of gross pay enables them to evaluate job offers, engage in more productive wage negotiations, and recognize the total value of their benefits package. Comprehending net pay is equally essential for budgeting and financial planning, enabling employees to handle their money wisely.

FAQs

How can I better plan my financials with gross and net pay?

You can determine your taxable income and adjust capital gains, business revenue, or retirement contributions by calculating gross pay. You can also set up a monthly budget and determine the amount you can allocate for certain expenses such as tuition, loan payments, utility bills or car rentals by understanding your net salary.

What are some of the common deductions for gross pay?

The common gross pay deductions are as follows:

- Income taxes withheld by the federal, state, and local governments

- Taxes on Social Security and on medicare

- Retirement account contributions

- Insurance premiums and contributions to health insurance or an FSA

- Court-ordered payments, like alimony, child support, unpaid taxes, credit card debt, or unpaid taxes

Is gross pay before or after taxes?

Gross pay is an individual’s total income before deductions, such as taxes and other payroll deductions.